Neat Tips About How To Buy Convertible Securities

Go ahead purchasing gabelli convertible and ome securities fund (the) stock by depositing fiat currencies, like usd or eur.

How to buy convertible securities. As of the third quarter of 2020, the u.s. In finance, a convertible bond or convertible note or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a. Victory incore investment grd convert fd.

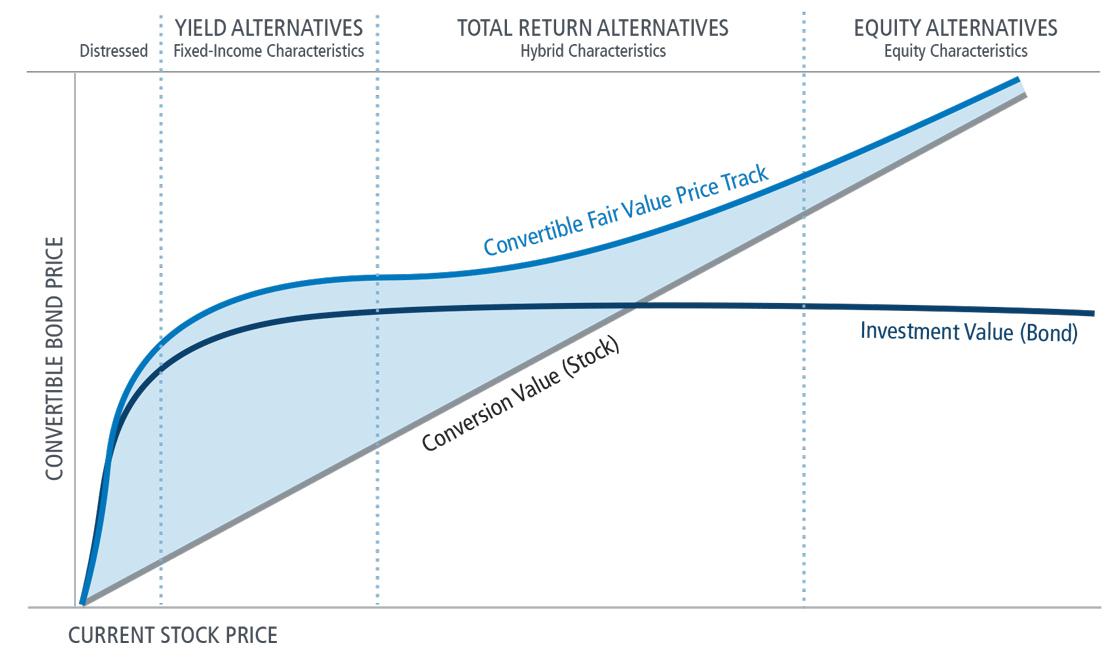

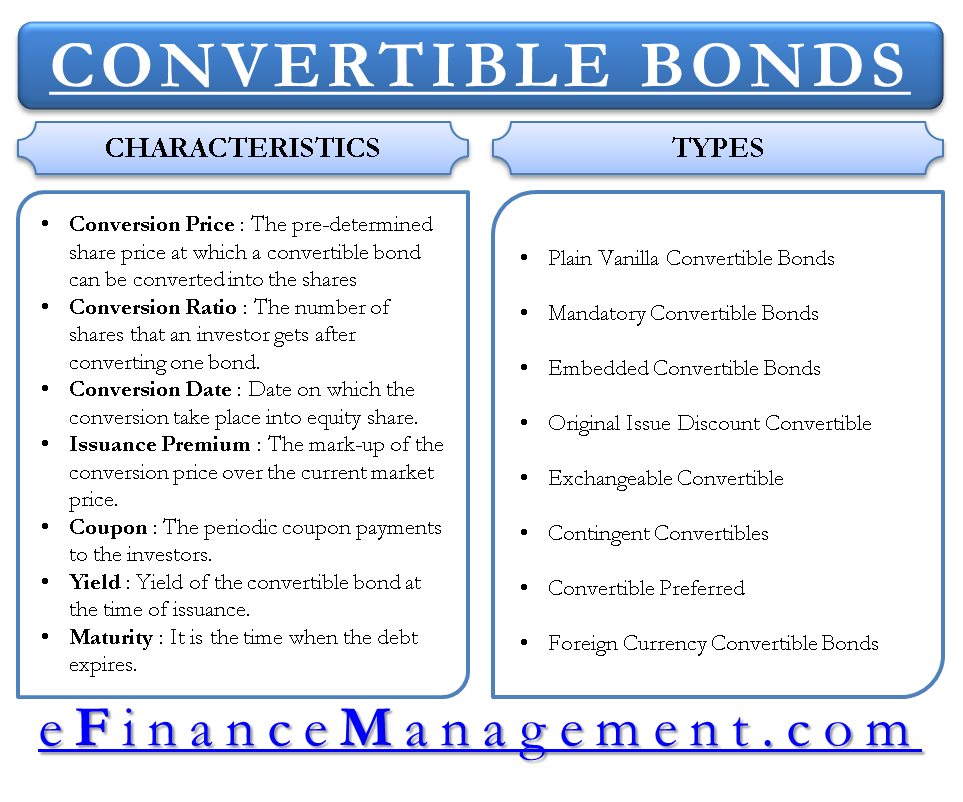

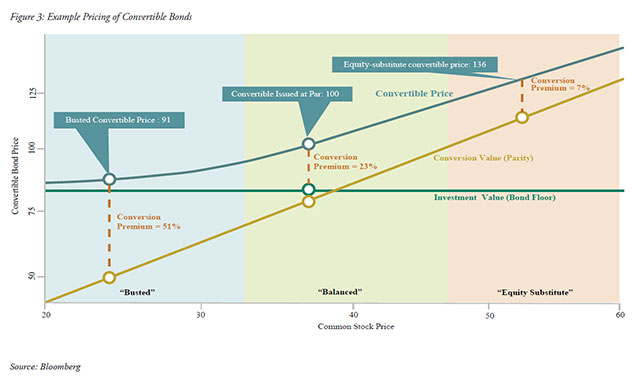

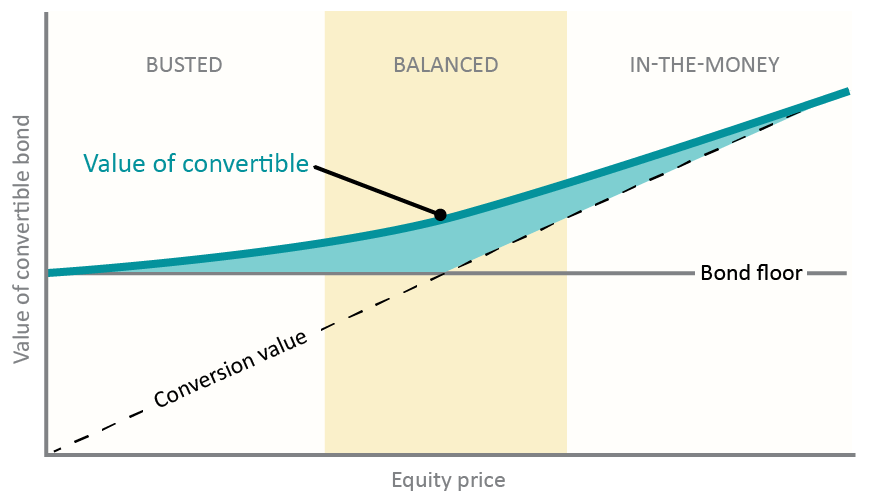

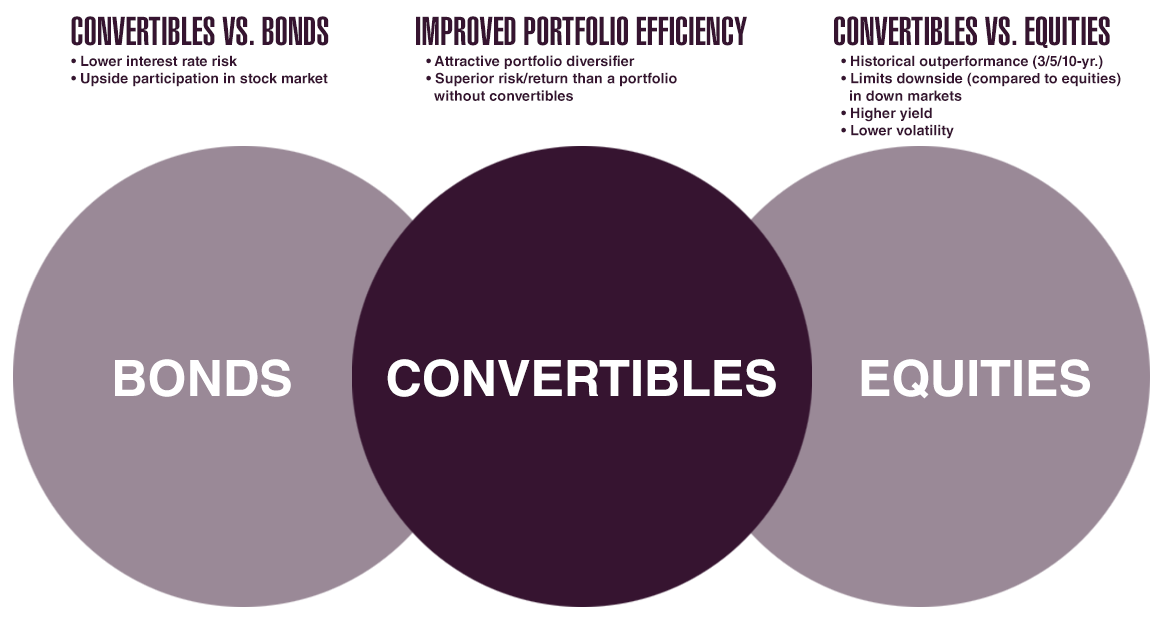

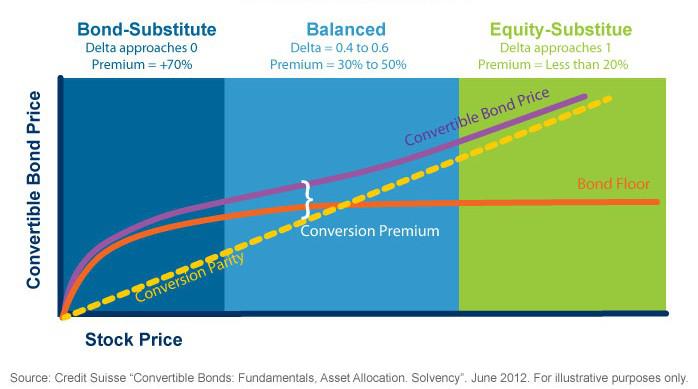

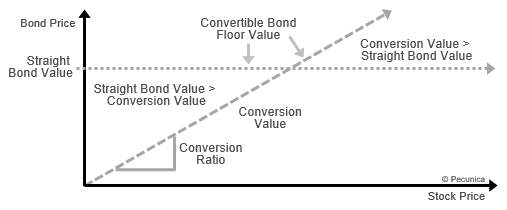

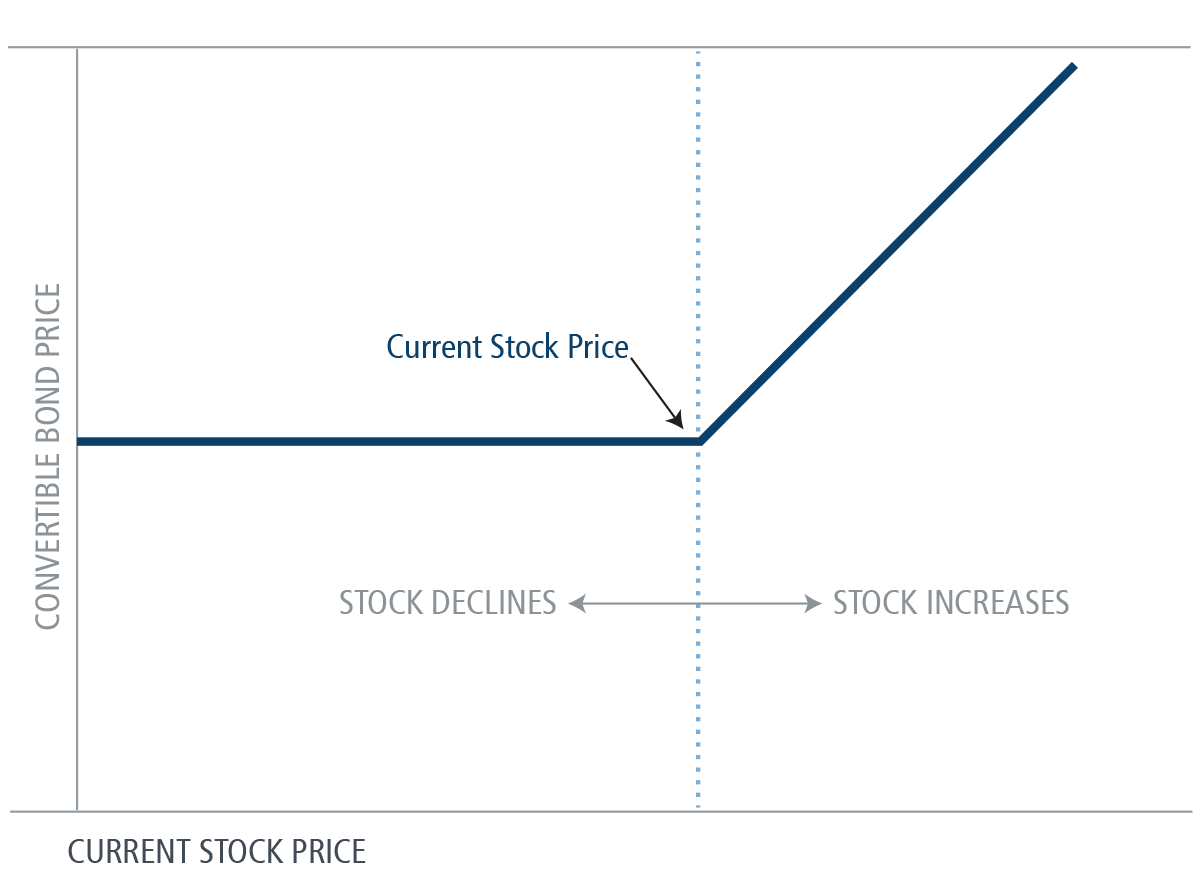

You must enter the stock symbol and number. Convertible securities, also called hybrid securities, are a special subset of securities. The volatility and return potential are driven by the value of the bond’s interest and redemption payments and the value of the equity option.

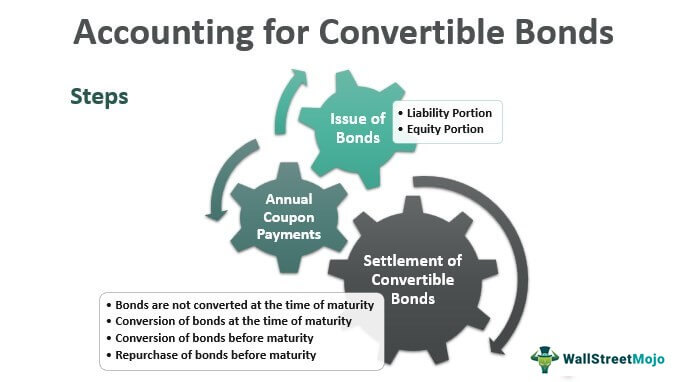

The most common forms of hybrid securities are convertible bonds and convertible preferred. Backing your account with eur or usd for trading can be done in a. Every bond pays a coupon rate, or the annual interest at a specific percentage.

If you want to buy individual bonds, you can do so through a brokerage with a bond desk and a specialist in convertibles. Convertibles also have greater price volatility. How to buy convertible bonds interested investors can purchase individual bonds through reputable stock brokerages and should specifically look for a broker that has a bond.

Here are the best convertibles funds. The bonds usually end up converting. If you do want to buy a convertible bond etf, the ones listed above should be available at any major broker.

There are several ways to invest in convertible bonds. For example, a lot of startups will issue convertibles to early stage investors in order to forego an agreement on valuation prior to raising money from a vc. Where to buy these convertible bond etfs.

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)